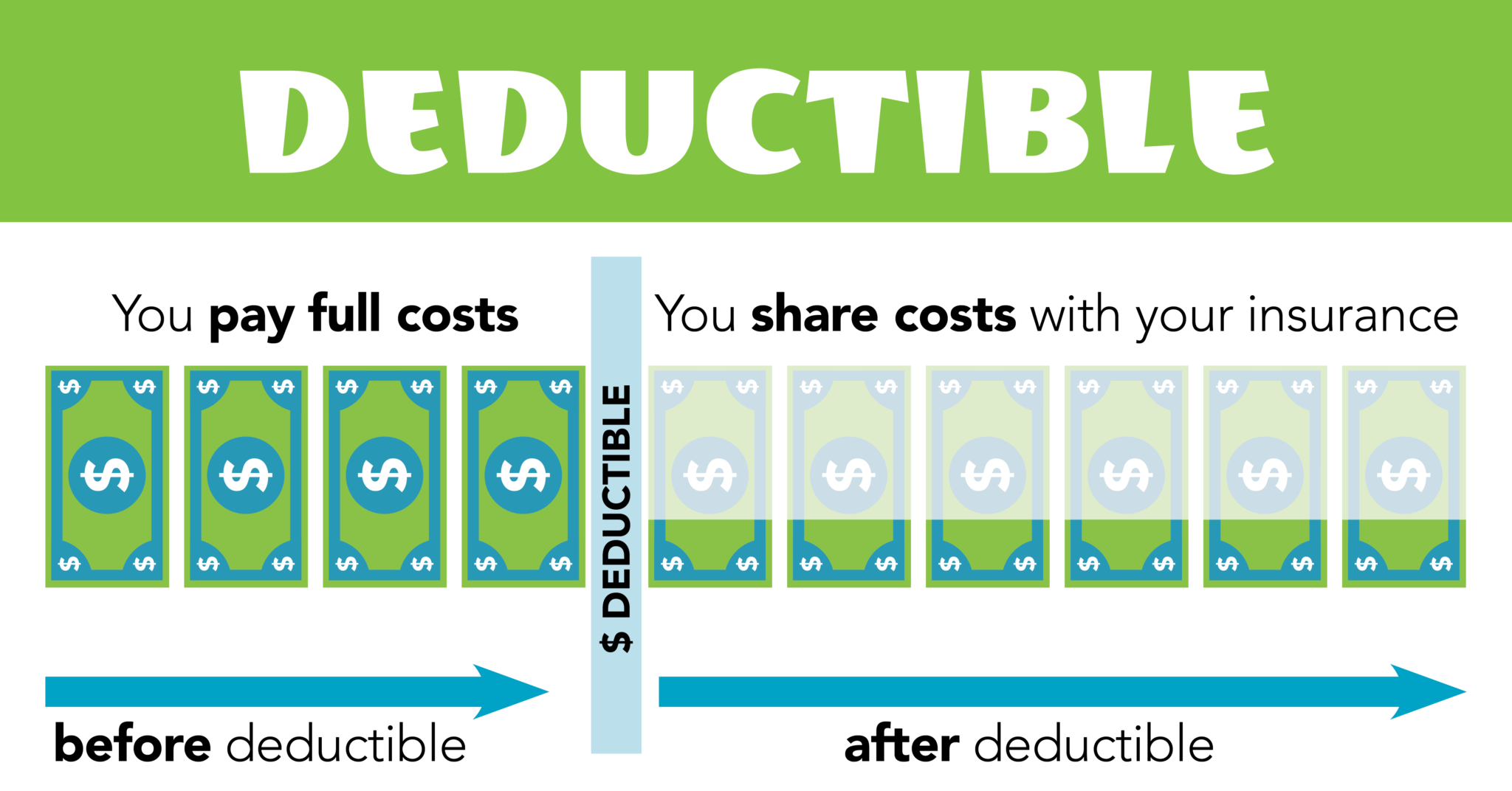

Turbo Tax Its Deductible 2025 Pdf. There has been a lot of discussion regarding changes to the child tax credit, but to date the child tax credit remains at up to $2,000. For participants with family coverage, an annual deductible that is not less than $5,550 but not more than $8,350 in 2025.

For participants with family coverage, an annual deductible that is not less than $5,550 but not more than $8,350 in 2025. There has been a lot of discussion regarding changes to the child tax credit, but to date the child tax credit remains at up to $2,000.

Turbotax 2025 Tax Return Estimator Dixie Frannie, For participants with family coverage, an annual deductible that is not less than $5,550 but not more than $8,350 in 2025.

Turbotax Service Code 2025 Pdf Eddie Gwennie, There has been a lot of discussion regarding changes to the child tax credit, but to date the child tax credit remains at up to $2,000.

TurboTax® ItsDeductible Online Track Charitable Donations for Tax, For participants with family coverage, an annual deductible that is not less than $5,550 but not more than $8,350 in 2025.

How to Delete Turbo Tax Account 2025 (StepByStep) YouTube, There has been a lot of discussion regarding changes to the child tax credit, but to date the child tax credit remains at up to $2,000.

At&T Asurion Deductible List 2025 Wilie Julianna, There has been a lot of discussion regarding changes to the child tax credit, but to date the child tax credit remains at up to $2,000.

Intuit TurboTax Its Deductible V2004, For participants with family coverage, an annual deductible that is not less than $5,550 but not more than $8,350 in 2025.

Turbo Tax Its Deductible 2025 Calculator Dodi Stacie, For tax year 2025, the child tax credit.

Turbo Tax Its Deductible 2025 India Veda Allegra, There has been a lot of discussion regarding changes to the child tax credit, but to date the child tax credit remains at up to $2,000.