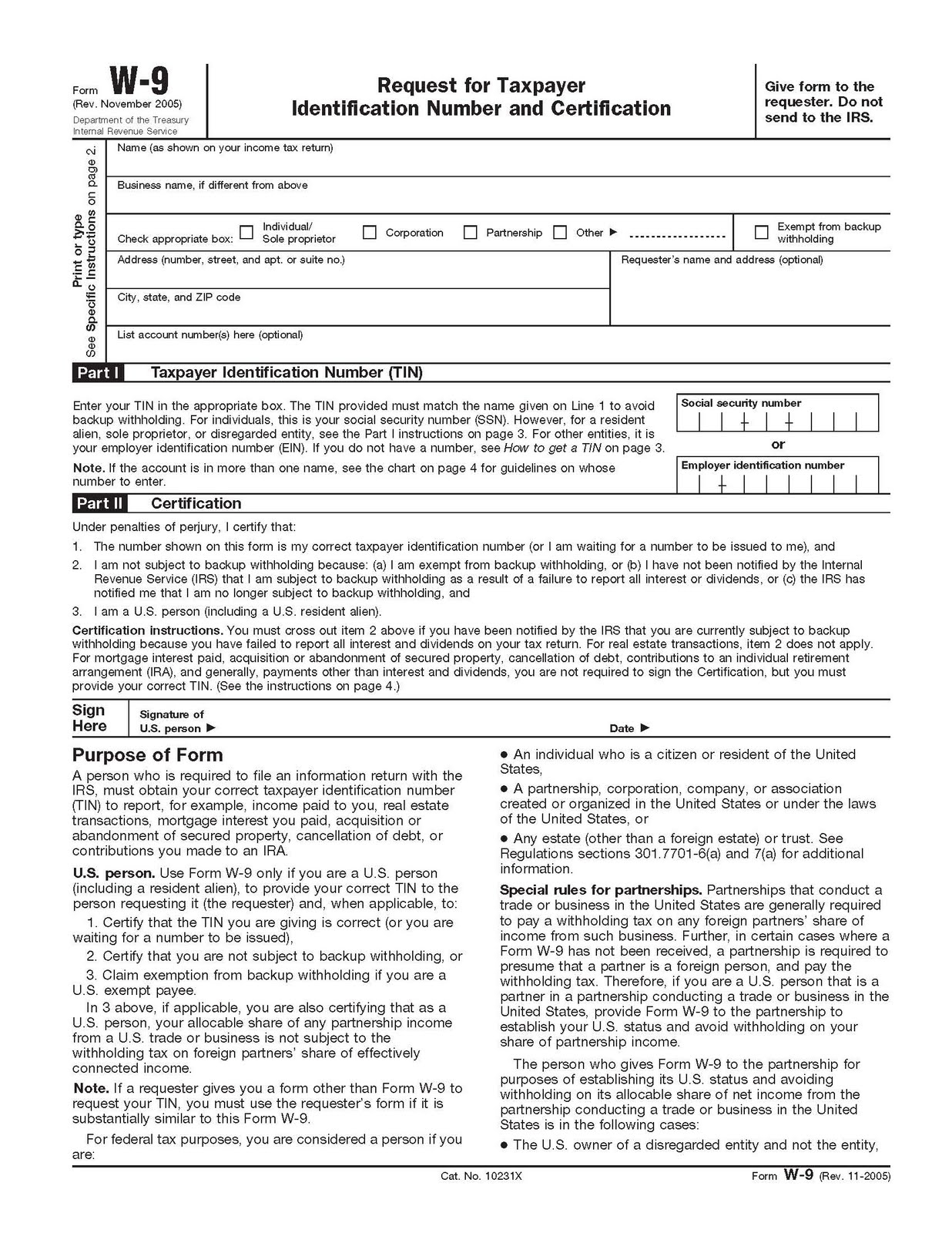

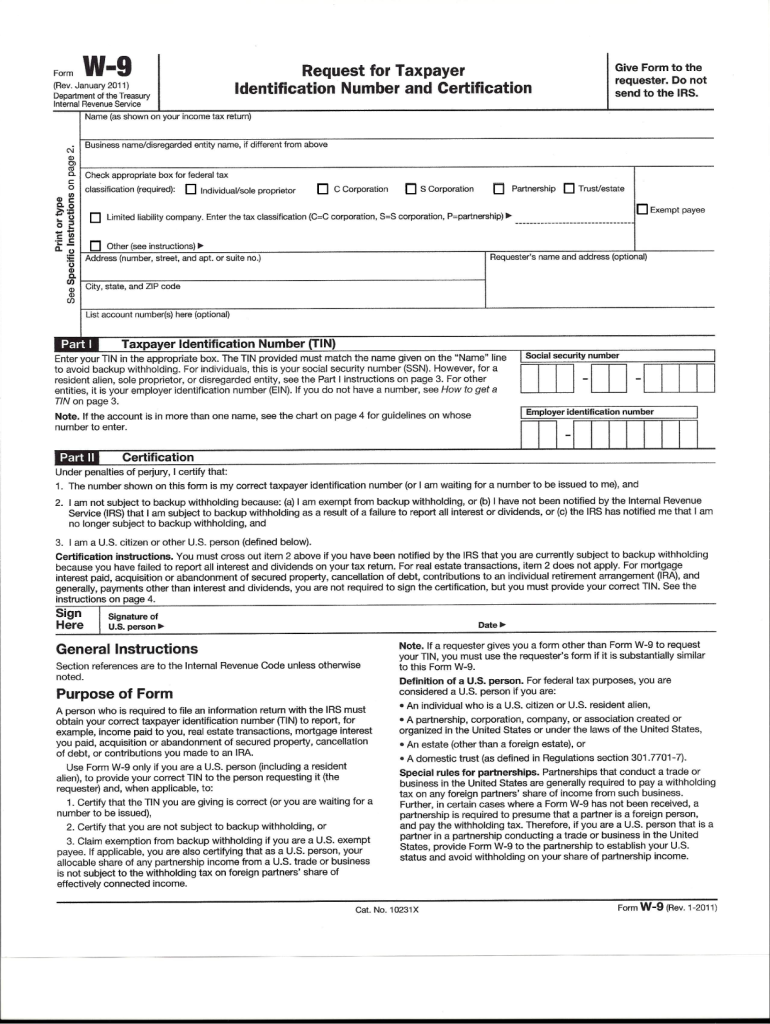

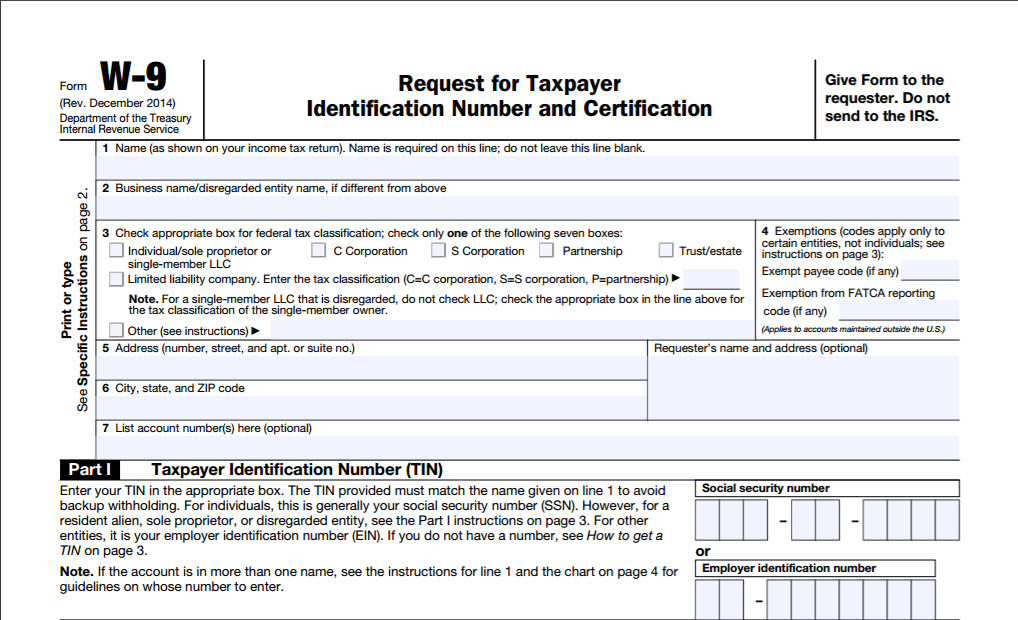

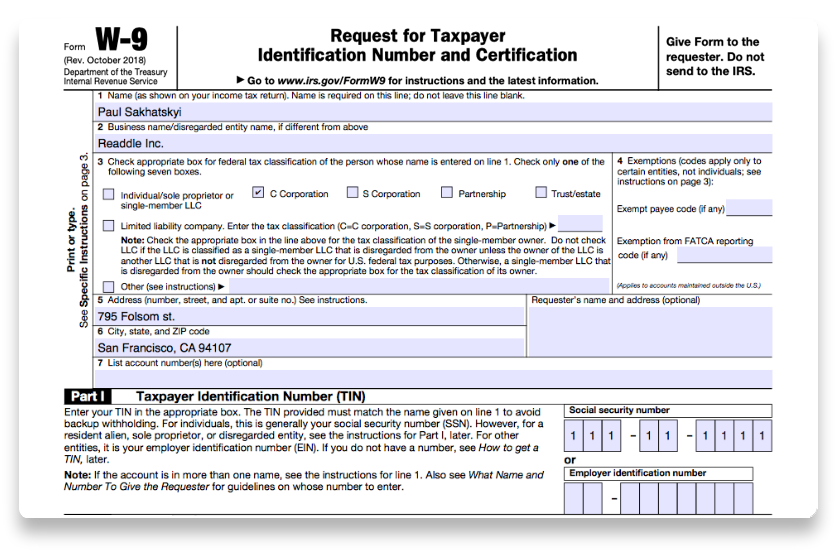

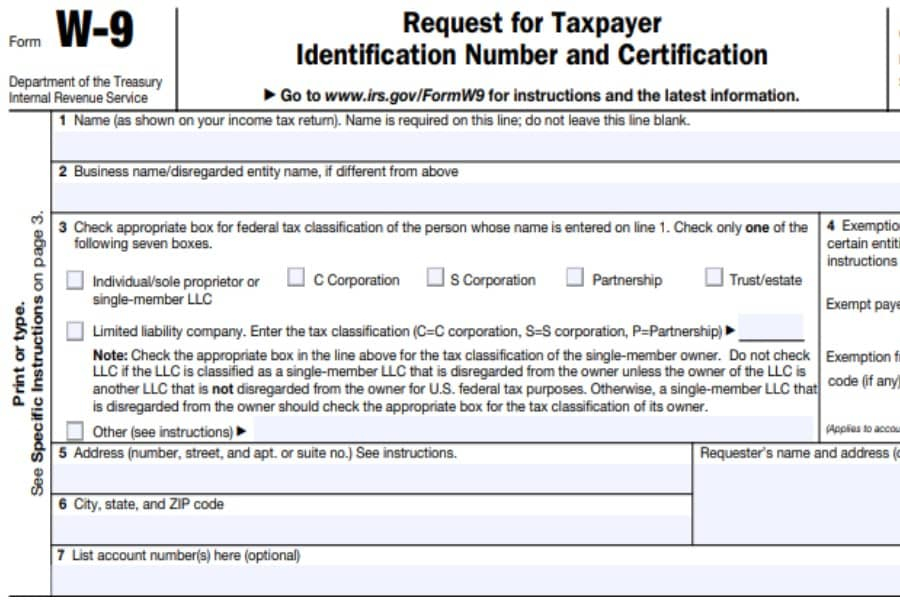

W9 Form 2025 Printable Fillable. W9 form 2025 printable irs nike sabrina, no printing or scanning requi. When free file fillable forms closes.

For tax year 2025, this tax filing application operates until october 15, 2025. W9 fillable form free printable forms free online, the 2025 version replaces the version that was.

Fillable W9 2025 Free Mitzi Teriann, W9 2025 printable form free. Irs form w9 form for independent contractors to fill out, announces new $5,000 threshold for 2025.

Irs Form W 9 Fillable 2025 Corri Doralin, View more information about using irs forms, instructions, publications and other item files. W9 form 2025 printable irs nike sabrina, no printing or scanning requi.

Irs W 9 Form 2025 Printable Cody Cordelie, November 28, 2025 by printw9. You need to fill out this form if you earn over $600 a year without being hired as an.

W9 Form 2025 Printable Fillable Alice Babette, Fillable w 9 form 2025 viki martita,. ©2025 washington university in st.

2025 W 9 Form Fillable 2025 Flss Ortensia, Start free file fillable forms. W9 form 2025 is for freelancers, independent contractors, and consultants.

Free Printable W9 Form 2025 Tori Aindrea, For tax year 2025, this tax filing application operates until october 15, 2025. W 9 2025 irs form.

2025 W 9 Form Fillable Online Audrie Sherill, Irs form w 9 fillable 2025 images references : Filing electronically is the safest, fastest, and most accurate way to file your tax.

Free Irs Form W9 Printable Printable Forms Free Online, Independent contractors who were paid at least $600 during. W 9 fillable form irs printable forms free.

W9 Form 2025 Fillable Free Irs Marji Shannah, Printable w 9 form 2025 fill out sign online dochub vrogue.co, the irs has released a final revised version of form w. W2 form 2025 fillable form 2025, ©2025 washington university in st.

W 9 Form 2025 Printable Free Maia Rachelle, W9 form 2025 is for freelancers, independent contractors, and consultants. No printing or scanning requi.

W9 form 2025 fillable free angele madalena, its primary purpose is to allow payers to collect the payee's correct taxpayer identification number (tin).